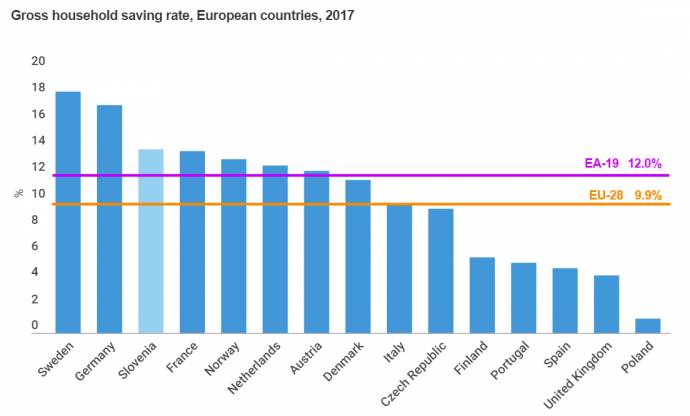

The gross rate, which shows what share of household disposable income is saved, increased by 0.9 percentage points on 2016, while most EU countries saw smaller increases or even declines.

Compared to 2016, household assets in Slovenia increased by 6.3% and liabilities by 5.3%, show data published by the Statistics Office on the occasion of 31 October, World Savings Day.

Cash and deposits (49.3%) stood out in the structure of household financial assets, followed by shares and other equity (26.9%) and insurance and pension schemes (16.6%).

Most of the liabilities, 87%, are loans. In 2014 they started to grow gradually, and in 2017 they increased by 6.3% over the previous year. The reason lies not only in the 4.5% increase in housing loans, but also in consumer loans, which increased by 12.4%.

You can dig deeper into the data here.