Ljubljana related

STA, 3 June 2021 - The Novo Mesto criminal police have apprehended a number of members of a drug trafficking organisation in cooperation with other police departments, seizing a large haul of illegal drugs worth millions of euros. The Slovenian police had been tipped off by the US Drug Enforcement Administration (DEA).

The police arrested 17 members, aged between 30 and 53, for drug trafficking and money laundering in mid-May.

France Božičnik, the head of the Novo Mesto criminal police, told today's online press conference that in early 2018 the DEA notified the Slovenian police it had been made aware of illegal activity perpetrated by individuals from Slovenia.

The individuals had been discussing the procurement of a large amount of cocaine in the Dominican Republic. The Slovenian police and their foreign colleagues uncovered that the Slovenians were part of a criminal organisation.

On 18 May this year, 18 house raids were conducted in Ljubljana, Nova Gorica and Celje, leading to a seizure of almost 80 kilos of various drugs, including cocaine, heroin and amphetamine, that were supposed to be distributed in Slovenia.

The police also found equipment for mixing, compressing and packing drugs. The analysis of the seized haul is ongoing, but according to an initial estimate the drugs are valued at millions of euros.

Nine of the 17 detained members have been taken into judicial custody. All of them are Slovenian citizens.

Seven individuals were also charged with money laundering after the police established that they had been part of an international money laundering network that was active in Italy, Germany, Serbia and Slovenia.

The criminal organisation of 17 Slovenians was allegedly run by a 36-year-old Ljubljana citizen, who was also in charge of drug procurement. Most of the suspects are familiar faces to the police.

At the start of the Covid-19 epidemic the police detected disruption in the drug supply networks, however drug trafficking organisations were quick to adapt and the epidemic has not had any significant impact on them, said Uroš Lavrič of the General Police Administration.

Slovenia saw an almost 78% increase in detected drug-related organised crime so far this year compared to the same period last year. Taking into account drug-related offences that were not committed as part of organised crime, the figure stands at 24%.

STA, 3 March 2021 - A total of 28 house searches were carried out in Slovenia Wednesday by the National Bureau of Investigation (NBI) in relation to a suspected money laundering scheme worth millions of euros. It unofficially involves tax advisor Rok Snežič and Bosnian citizen Dijana Đuđić.

In addition to Slovenia, house searches were also carried out in Croatia and Bosnia-Herzegovina as the scheme is being investigated that allegedly involved a number of Bosnian citizens, with Slovenian Rok Snežič as the mastermind.

Unofficial information by POP TV says that he was helped in the money laundering scheme by Dijana Đuđić, a Bosnian citizen known for a controversial EUR 450,000 2017 loan to the Democratic Party (SDS) of Janez Janša, currently the ruling party in Slovenia.

The Bosnian authorities are conducting a parallel organised crime and money laundering investigation, which targets Đuđić and the persons connected with her in Bosnia-Herzegovina. A house search was reportedly carried out today at her home.

Snežič is suspected of having organised a group of citizens of Bosnia-Herzegovina who opened bank accounts in Slovenia, Austria and Hungary, on which they received money as payment for fictitious services performed by shell corporations.

They would then withdraw the money from the banks in cash, and Snežič is suspected of taking Đuđić personally from Bosnia-Herzegovina to Slovenia several times to withdraw cash there.

Unofficially, the illegal transactions worth millions of euros also involved the companies owned by Roman and Dominik Vuk, the brother and son of Miran Vuk, the former mayor of Zavrč. They used to be provided tax advice services by Snežič.

The latter is suspected of giving instructions to the persons involved in the money laundering scheme and organising the chain of financial transactions. Điđić used to make cash withdrawals of up to EUR 400,000 at once.

The financial transactions made by Đuđić raised red flags years ago at the Slovenian Office for Money Laundering Prevention, which suspected that it was money laundering.

Acting NBI director Petra Grah Lazar told the press today that eight house searches were still under way. She added that the NBI had launched the investigation in 2018 based on various tips. Foreign authorities are also involved.

The Slovenian and foreign suspects are suspected of committing several criminal acts between 2016 and 2018, including the issuing of unwarranted receipts for various services to receive a total of EUR 7 million in illegal gains, Grah Lazar said without naming any suspects or other details of the investigation.

Asked whether the EUR 450,000 loan from Đuđić to the SDS, which was later returned, was part of these transactions, she said that she was not able to provide concrete information but noted that no political party was being investigated.

A total of 19 persons have been made suspects as part of the investigation, and neither of them have been detained, the police also said.

STA, 3 December 2020 - As part of the latest effort to crack down on money mule schemes in Europe, a total of 81 cases have been investigated in Slovenia, in which 102 money mules have been identified. A total loss by legal entities and individuals of EUR 2.1 million has been prevented, the Bank Association of Slovenia announced on Thursday.

Money mules take part - often unknowingly - in money laundering activities by receiving and transferring illegally obtained money between bank accounts and/or countries.

The sixth European Money Mule Action (EMMA6), coordinated by Europol and involving law enforcement authorities from 26 countries, was conducted between 15 September and 30 November.

It resulted in the identification of 4,031 money mules as part of 1,159 criminal investigations. A total of 422 persons have been arrested in the sting that also involved the Slovenian police.

The operation featured more than 500 banks and financial institutions which helped to report 4,942 fraudulent money mule transactions, preventing a total loss of EUR 33.5 million, the Bank Association of Slovenia said.

According to the Slovenian police, a total of 81 cases have been investigated in Slovenia, in which 102 money mules have been identified.

In cooperation with the Office for Money Laundering Prevention, Slovenian banks and foreign security authorities, a total loss of EUR 2.1 million by legal entities and individuals has been prevented.

Money mules take part - often unknowingly - in money laundering activities by receiving and transferring illegally obtained money between bank accounts and/or countries.

They are recruited by criminals and paid a fee to launder money gained illegally through information or cyber fraud, including breaches into information systems, interception of business correspondence or re-routing of payments.

According to the Bank Association of Slovenia, the message of this year's campaign is that people should be careful not to become a link in a money laundering chain.

"If you think that someone you know is a money mule, inform them immediately about the consequences of their acts," it said, adding that suspicions should be reported to the police and the relevant bank.

The EMMA operation is part of a project implemented within Europol's Cybercrime Payment Fraud Operational Action Plan, which targets cybercrime and money laundering and aims to raise public awareness in these fields.

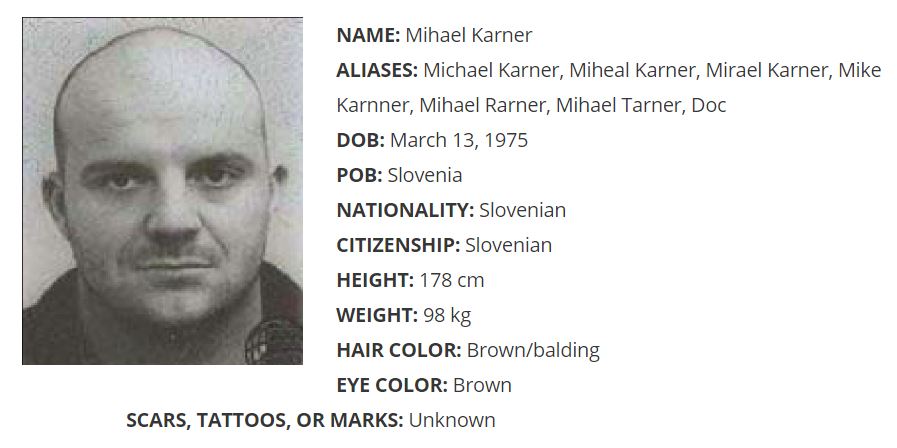

STA, 7 July 2020 - The Ljubljana city council has confirmed changes to the municipal spatial plan for a former industrial area in the borough of Vič, where a residential complex is planned to be built. Several councillors have raised the issue of the investors including Mihael Karner, a Slovenian who is wanted by the US.

The council confirmed the project in a 21:15 vote on Monday to transform the site of the former Tovil factory in the south-western borough into a complex featuring 140 apartments, including up to 60 assisted living apartments.

The approximate location of the project

state.gov

The main investor in the Urban Oasis project is entrepreneur Mihael Karner, who is being sought by the Drug Enforcement Administration (DEA) with an international warrant for alleged distribution and import of anabolic steroids and money laundering.

Gregor Slabe of the Democrats said he was convinced that the US services were monitoring today's session and that they would certainly make a record of which councillors had endorsed Karner's project.

"The US is requesting extradition of Karner, his wife and brother. Since you failed to support our proposal to withdraw this disputable item from the agenda, you will be the ones held responsible for international diplomatic consequences," he added.

Igor Horvat (SDS) noted that, according to the media, the investors were companies which had not had any revenue recently, and no employees. He added that the plan's approval might jeopardise Slovenia's international reputation.

There is concern that Ljubljana will only get another construction pit, said Ksenija Sever, also of the SDS. "The investors will get loans, sell apartments, and then vanish, so that taxpayers can pay for another banking hole."

Asta Vrečko of the Left added that the investors were problematic and that the "municipality is doing favours to very disputable companies".

Vice Mayor Aleš Čerin, who chaired the session due to the absence of Mayor Zoran Janković, who is in quarantine after having a contact with a person who tested positive for coronavirus, said that the spatial plan was not about an individual investor, but spatial planning.

"Nowhere is written that the gentlemen you spoke about will be the actual investors", he said, adding that they were Slovenian citizens who had no criminal record in Slovenia.

STA, 13 February 2020 - There was much controversy on Thursday as the parliamentary Commission for the Oversight of Intelligence and Security Services discussed the state prosecution's decision to reject a criminal complaint filed by a parliamentary inquiry over an alleged Iranian money laundering scheme at NLB bank a decade ago.

Addressing reporters after the session, Janez Janša, the leader of the Democrats (SDS), said that the session heard "things that explain much of what is happening" and what was keeping the media busy these days, something that would become very concrete in the future, which he said was "from now on".

After what the commission heard today, Janša said it had become obvious why the "law enforcement authorities that should have investigated the matter found there was nothing wrong (...) People who made possible a criminal act of epic proportions investigate themselves."

Darko Muženič, now director of the National Bureau of Investigation (NBI), served at the Office for Money Laundering Prevention at the time that roughly one billion US dollars was allegedly laundered through NLB bank.

In a bid to "protect the dignity and integrity" of the NBI and Muženič, Police Commissioner Tatjana Bobnar explained today that Muženič at the time served in the department of the Office for Money laundering that was not in charge of the Farrokh case.

Farrokh was the name of the company of Iranian citizen Iraj Farrokhzadeh that the parliamentary inquiry in 2018 found laundered the money on behalf of Iran to skirt international sanctions.

The prosecution's decision of July last year not to prosecute abuse of office suspects in the case was debated by the parliamentary Home Affairs Committee on Wednesday, but the session was suspended because the SDS and the fellow conservative New Slovenia (NSi) wanted to hear from NBI and NLB representatives, who were not present at the session.

NSi deputy Jernej Vrtovec described the findings of investigators which prompted the prosecution not to prosecute as very unusual.

The case was the subject of two parliamentary inquiries, whose extensive reports allege that NLB bankers failed to exercise due oversight and abused their powers at last in the case of some transactions, said Vrtovec.

The police said that that Tuesday's session of the Home Affairs Committee was attended by Police Commissioner Bobnar, who is the NBI director's superior, and director of criminal police Boštjan Lindav.

The police noted that it was the criminal police and not NBI investigators which in 2010 and 2011 handled the case of alleged money laundering at NLB.

Bobnar noted that the police directorate had reviewed police activities in that case 2017 and that the guidelines issued by the then interior minister in connection to that had been fully implemented.

She said that the special department of the specialised prosecution service had rejected a criminal complaint filed against criminal police investigators over the case.

Bobnar also said that the police performed their duties in accordance with the standards of evidence, in compliance with the constitution, penal code and the criminal procedure act and as an independent body whose work in the pre-trial procedure can only be directed by the state prosecutor in charge.

A specialised investigation group formed in 2017 and comprising representatives of the NBI, Office for Money Laundering Prevention and the central bank drew up a plan of work in the Farrokh case to look into suspected criminal offences, including money laundering, terrorism financing and abuse of office.

In the case pertaining to suspected abuse of office, the state prosecutor in charge issued a decision in July 2019 rejecting the criminal complaint by the parliamentary inquiry.

However, Bobnar noted that the specialised investigation group continued work in connection to other suspected criminal offences in the case.

All our stories on money laundering are here, while those on Iran are here

STA, 12 February 2020 - The European Commission has issued a letter of formal notice to Slovenia and seven other member states for failing to transpose the 5th anti-money laundering directive. Anti-money laundering rules are "instrumental in the fight against money laundering and terrorism financing," the Commission said on Wednesday.

It added that recent money laundering scandals had revealed the need for stricter rules at EU level and that legislative gaps in one member state had an impact on the EU as a whole.

EU member states were obligated to transpose the directive by 10 January, however, Slovenia, as well as Cyprus, Hungary, the Netherlands, Portugal, Romania, Slovakia and Spain, failed to do so.

Unless the countries fail to provide a satisfactory response to the Commission within 2 months, the Commission will send them reasoned opinions, after which they get another two months to act or else face the European Court of Justice.

In December, Slovenia's National Assembly passed changes to the act on anti-money laundering and terrorism financing, transposing into Slovenian legislation the 4th anti-money laundering directive adopted by the Commission in 2016.

The Finance Ministry meanwhile said that it had stepped up efforts to draft the needed legislation after receiving the formal notice. The ministry expects the draft changes to be filed in government procedure shortly.

The covers and editorials from leading weeklies of the Left and Right for the work-week ending Friday, 17 January 2020

Mladina: Health bill vote may be behind attempt at govt destabilisation

STA, 17 January 2020 - "It is unclear what or who causes hysteria in Slovenian politics," the left-wing weekly Mladina says as it analyses peculiar events before the congress of the coalition Pensioners' Party (DeSUS) and opposition Democrat (SDS) leader Janez Janša's latest attempt to destabilise the government.

Editor-in-chief Grega Repovž accuses the media for helping create the hype around tomorrow's DeSUS congress by demanding senior DeSUS members reveal who they will support in the leadership battle between incumbent leader and Defence Minister Karl Erjavec and his most serious challenger Agriculture Minister Aleksandra Pivec.

"Is it really unusual that not all DeSUS MPs are behind Erjavec," wonders Mladina on Friday. "Since when is it normal for all MPs to have the same opinion and since when one has to say it loud and clear before a secret ballot which candidate one supports".

What is wrong if there are challengers to the party leader at a congress, Repovž says, but points to the fact that there are many "personal" parties in Slovenia which have the party leader's name in their name so it is hard to imagine them being led by anyone else.

He implies that "such a perception of democracy probably stems from at least some fascination with the only orderly party in Slovenia, namely the SDS, which does not wonder who would stand for party president even if Janša's name in nowhere to be found in the party's name".

However, it is clear that this fire is being kindled by those who would like to destabilise the government - the opposition, says Repovž, but adds there is nothing wrong what that, this is something the opposition does.

Janša's intention is clear, he wants to make coalition parties and the prime minister nervous, Repovž says in reference to his Sunday interview in which he said the government coalition was clinically dead.

But there could also be more substantive reasons to undermine the government, Repovž says, noting a bill to abolish top-up health insurance and stop further privatisation in healthcare will go into third reading at the end of January.

Neither the SDS nor the opposition New Slovenia (NSi) or DeSUS hide their connections with the health insurance lobby, which is trying to undermine the bill at all cost. This could perhaps be the reason for trying to destabilise the government before a key vote, according to Mladina.

Demokracija: Iran-NLB case comes with an inconvenience

STA, 16 January 2020 - While the investigation into the contentious transactions worth US$1 billion by a British-Iranian citizen through the NLB bank is still ongoing, the "inconvenient" thing is that the head of the National Bureau of Investigation is actually investigating himself and "protecting political godfathers", the right-wing Demokracija says in its latest commentary.

The right-leaning weekly refers to Iraj Farrokhzadeh, who is suspected of laundering Iranian money through his NLB accounts in 2009-2010 in breach of anti money-laundering legislation, while Iran was subject to international sanctions.

The commentary comes after the Specialised State Prosecution announced earlier this month it had abandoned a part of the investigation related to abuse of office by bankers at NLB.

The announcement came "at the moment when the democratic world was being appalled by Iran, when new sanctions and similar investigations of money flows from Tehran to cells around the world were being announced".

"The matter is not innocent. Farrokh, the Iranian company owned by Iraj Farrokhzadeh, laundered a billion dollars through NLB between 2008 and 2010, during the government coalition under the Social Democrats (SD) and Borut Pahor."

In the commentary Length of the Shadow of a Dollar Banknote, editor-in-chief Jože Biščak adds that there is suspicion that the money was used to purchase goods that could be used for nuclear armament.

"In other words, at the time of international sanctions against the regime in Tehran, the Slovenian state-owned bank helped Iran break through the embargo."

The investigation is still ongoing, but the "inconvenient" thing is that Darko Muženič, the head of the National Bureau of Investigation, is actually investigating himself and protect political godfathers.

Demokracija refers to Muženič serving as the head of the Office for Money Laundering Prevention when the scandal broke out in 2017.

"He apparently became the boss of the National Bureau of Investigation only to steer the investigation so that only pawns on the chessboard are (possibly) eventually found guilty," it adds.

But those who think that foreign intelligence services (US in particular) are not informed in detail about the true perpetrators and that they do not know what the modus operandi was, are so wrong.

"If nothing happens and perpetrators do not get punished, sanctions against Slovenia, formally still an ally of the US and western democracies, will not be visible and public, but they will be very painful."

All our posts in this series are here

STA, 27 September 2019 - While the Financial Administration (FURS) has just highlighted the continuing positive trend in the recovery of tax debt, it is bound to have a hard time recovering what are EUR 25 million owed by one of the biggest tax debtors in the country. Zlatan Kudić reportedly disappeared as a tax fraud trial against him was about to end.

According to Thursday's report by public broadcaster TV Slovenija, the former director of the Ljubljana company Maxicon, which went into receivership in 2012, has had an arrest warrant issued against him.

Kudić was undergoing a trial, along with two co-defendants, for tax evasion, money laundering and destruction of evidence.

The court ordered that he be detained when he stopped attending trial a few weeks ago and the police issued an arrest warrant, but so far to no avail.

According to TV Slovenija, Kudić and Maxicon have been erased from the list of tax debtors with the company's termination, but FURS could theoretically still go after the debt via a pecuniary claim in a criminal procedure.

The question, however, is whether Kudić will ever again be available to Slovenian courts and whether he officially has any assets at all, the report added.

STA, 15 July 2019 - Reporter, the right-leaning weekly, analyses the background story of the Slovenian citizen Mihael Karner and his web of accomplices who have allegedly made a fortune selling steroids online.

The editorial believes that the story probably started at an office in the Augusta villa in Ljubljana more than 20 years ago, with young men hanging out, working out and discovering the effects of anabolic steroids.

"There it was that those young men probably came up with this "business idea" and developed it into a global business in the following years.

"Since they walked the razor's edge and likely even crossed it, the group, who was dubbed a criminal organisation by the US Drug Enforcement Administration (DEA), was making easy money and a lot of it, which mostly ended up in real estate projects in Slovenia and its neighbouring countries through a complex tax haven scheme."

Karner and his wife were then arrested in Austria in late 2011 on US Federal indictment for conspiracy to distribute anabolic steroids, conspiracy to import anabolic steroids and conspiracy to launder money.

The editorial presumes that Karner and his wife met through her brother who socialised with Karner at the villa. Another link was the wife's uncle, Danilo Slivnik, who set up the office there.

The editor-in-chief Silvester Šurla points out that allegedly several members of Slivnik's family were involved in Karner's illicit drug business, but the US government has targeted only two other people apart from Karner himself - his wife and his brother, offering up to five million dollars each for any information on their travelling abroad plans which would help to arrest them.

The three targeted people could thus face extradition to US and up to 20 years in prison. Slivnik, who was involved in Karner's real estate business projects, which were a way to launder the money gained through selling anabolic steroids, committed suicide soon after the 2011 arrest.

"It's tragic and rather sad that Slivnik paid the biggest price in this unfortunate story, a man who was only a supporting actor in this scandal and was not involved in anabolic steroids trafficking as opposed to his relatives," says the editorial, concluding that Slivnik was never a target of the US government investigation.

Related: US Govt Offers Millions to Catch Slovenian Steroid King

STA, 2 April 2019 - The Koper District Court sentenced on Tuesday former Istrabenz general manager Igor Bavčar to two years and six months in prison for abuse of office. Since he is already serving a five-year prison sentence for money laundering related to a deal involving Istrabenz shares, he was handed a uniform sentence of seven years and five months.

The other defendant, former Maksima Holding director general Miroslav Golubić, got a prison sentence of a year and eight months.

The prosecution demanded two years and a half for Bavčar and two years for Golubić.

The pair were on trial over a 2007 deal involving a purchase of Intereuropa shares.

The Istrabenz conglomerate entered a forward contract Maksima Holding had with the bank Banka Celje which set down a mandatory purchase of Intereuropa shares at a set price and in a specified period.

It bought almost 288,000 Intereuropa shares at 49 euro a piece from Banka Celje on 20 December 2007 at a price of EUIR 14.1m, and sold them back to the bank a day later at 36 euro a piece, or for around EUR 10.4m.

The prosecution has argued that by overpaying the shares by EUR 3.7m, Istrabenz incurred the damage that would have been otherwise incurred by Maksima Holding.

The court ordered today that all assets illegally gained by Maksima Holding be confiscated.

The ruling is not final yet.

The head of the judicial panel, Orjana Trunkl, said the deal was unnecessary, even harmful for Istrabenz. Bavčar clearly ventured into it to prevent damage to Maksima Holding, she said.

This was in his best interest as the absolute owner of the company FBI, which held a controlling stake in Maksima Holding, which was preparing the ground for the takeover of Istrabenz.

Golubić, whom the court found to be actively helping Bavčar, received a milder sentence because he was an accomplice and had no previous criminal record.

Neither of the defendants were in court today, but given their line of defence, they will probably lodge an appeal.

The prosecution in contrast, is happy with the ruling and will not appeal unless any procedural problems arise.